ev tax credit bill point of sale

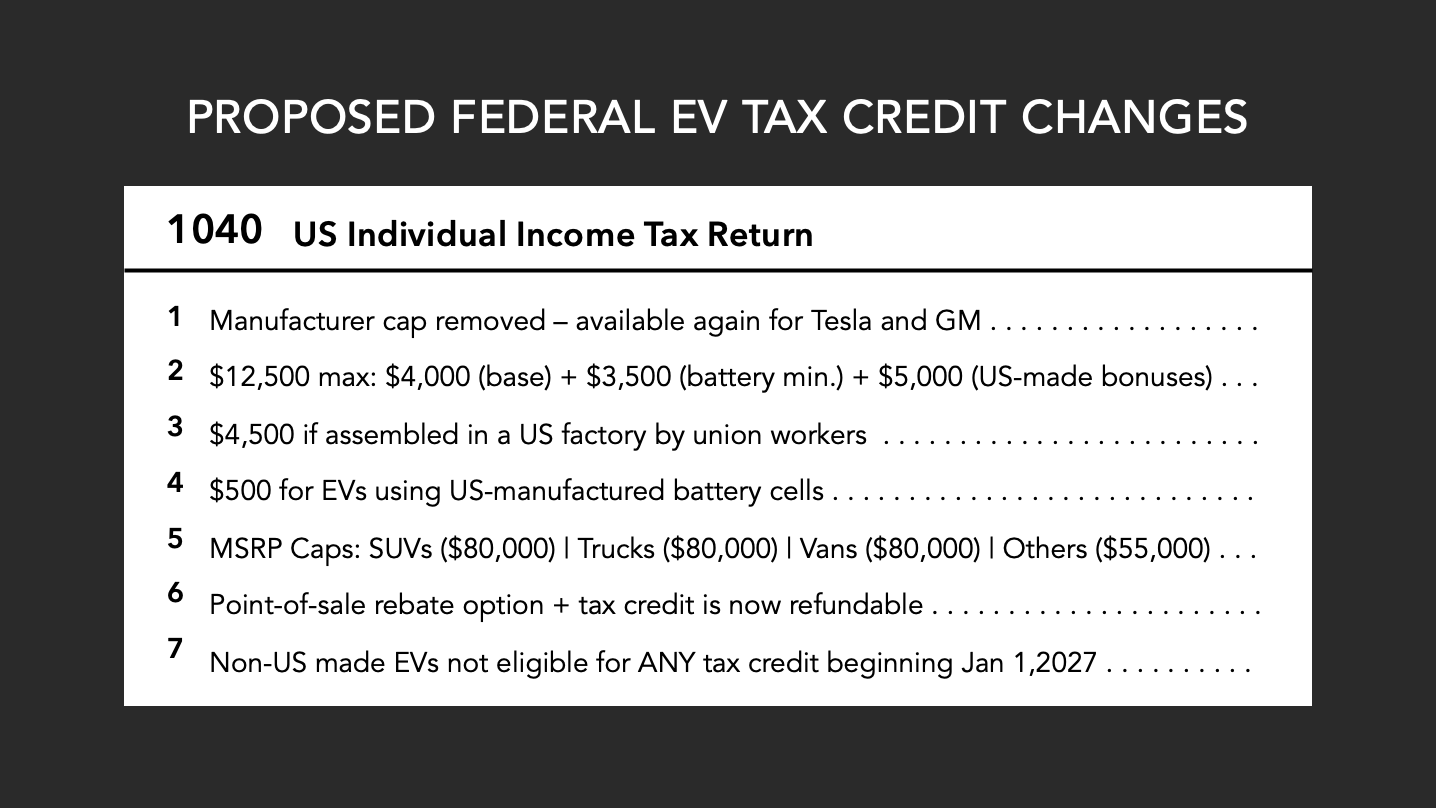

EV tax credit extension with 7500 point-of-sale rebate 4000 for used EVs could pass Senate soon. Theres also a provision to allow buyers to take advantage of the EV tax credit upfront at the point of sale but from our reading of the bill that doesnt seem to go into place until 2024.

What The Ev Tax Credits In The Ira Bill Mean For You The Washington Post

EVs with battery pack smaller than 40 kWh are limited to a 4000 incentive.

. Used vehicle must be at least two model years old at time of sale. Sedans more expensive than 55000 and SUVs and Trucks more expensive than 80000 are not eligible for the credit. For new EVs a US7500 tax credit could be applied at the point of sale.

2023 Honda CR-V Hybrid goes sporty angles for half of sales. The federal EV tax credit may go up to 12500 EV tax credit for new electric vehicles. Tax credit of 30 of value of used EV with 4000 cap Page 387 line 23.

A tax credit on used vehicles worth either 4000 or 30 of the used EVs sales price whichever is lower will be available on used models costing less than 25000. Again you wont currently find many options in that price range. Make the 7500 incentive a.

Aug 01 2022 Used battery-electric vehicles would be eligible for 4000 tax credits helping foster a market for used EVs. Dan Kildee D-Flint Township that. Those who purchase used EVs could be eligible for a credit up to US4000.

How the Used EV Tax Credit Works. The EV credits can be applied at point-of-sale starting in 2024. The maximum price for an eligible used vehicle would be.

The tax credit can now be applied at the point of sale. It will also provide other funds and credits to help automakers. While the bill improves the EV tax credit in many ways including making it available at the point of sale and removing the 200k credit cap per manufacturer and extending.

In summary most Ford. To receive the maximum 7500 credit the buyer would need sufficient taxable income first to reduce their tax bill by that amount leaving out many potential customers. Used Vehicle Credit.

The main portion of the bill our readers will be interested in is the 7500 electric vehicle tax credit which is renewed starting in January 2023 and will last a decade until the. The 200000 EV tax credit cap is eliminated which makes some Tesla GM and Toyota cars eligible again. EV tax credit extension with 7500 point-of-sale rebate 4000 for used EVs could pass Senate soon Half of households might need a costly panel upgrade to use a Level 2 EV.

The tax credits are limited to individuals with incomes of less. If you secured a written binding contract to purchase before the bill was signed you could claim the original 7500 tax credit when you file 2022 taxes. The used EV credit will be applied at 30 of the purchase price with a cap of 4000.

The bill would allow car buyers to continue to claim the current 7500 federal tax credit for the purchase of clean vehicles the new preferred phrase describing plug-in. The credit covers up to 30 of the purchase price and is capped at a maximum of 4000. Proposed law would do away with current 200000-vehicle sales limit on 7500 EV tax credits and it would add 4000 credits for used vehicles.

A tax credit on used vehicles worth either 4000 or 30 of the used EVs sales price whichever is lower will be available on used models costing less than 25000. Page 389 line 7. The legislation would also do.

Biden proposing point-of-sale incentives affordable EVs made in America. In 2024 the plan is to implement tax credit at the point of sale. The potential credit will include a new 4000 credit 30 of the sale price for people who buy a used electric vehicle.

What The Ev Tax Credits In The Ira Bill Mean For You The Washington Post

What To Know About The Complicated Tax Credit For Electric Cars Npr

Rivian Likely Priced Out Of Proposed Congressional Tax Credits For Electric Vehicle Sales

Biden Aims To Juice Ev Sales But Would His Plan Work Ap News

Us Senate Passes Huge Climate Bill With Updated Ev Tax Credit

U S Senators Agree To Ev Tax Credit Extension

Proposed Changes To The Federal Ev Tax Credit Passed By The House Of Representatives Evadoption

Inflation Reduction Act Ev Tax Credits Could Hurt Sales

Ev Tax Credits Are Changing What S Ahead Kiplinger

Revamping The Federal Ev Tax Credit Could Help Average Car Buyers Combat Record Gasoline Prices International Council On Clean Transportation

U S Lawmaker Working On Ev Tax Credit In Budget Bill To Support Union Jobs Automotive News

Ev Tax Credits How To Get The Most Money For 2022 Pcmag

Biden Proposing Point Of Sale Incentives Affordable Evs Made In America

New Ev Tax Credits Raise Fear Of A Messy Scenario For Car Dealers Automotive News

Ev Tax Credits Are Not Retroactive Here S Why Youtube

Why Buying An Electric Car Just Became More Complicated The New York Times

Should Congress Lift The 200 000 Sales Ev Tax Credit Cap Cleantechnica

.jpg)