flow-through entity tax form

Instructions included on form. If the property is a cottage rental property or other non-qualifying real property your ACB is your designated proceeds of disposition minus the reduction.

Understanding The 1065 Form Scalefactor

The minimum required estimated tax payment is the greater of 50 of the prior year elective tax paid or 1000.

. Form W-8 IMY may serve to establish foreign status for purposes of sections 1441 1442 and 1446. File Form 5156 Request for Tax Clearance Application if you. Instructions included on form.

Trade or business and dispositions of interests in partnerships engaged in a trade or business within the United States made to a foreign flow-through entity are the owners or beneficiaries of the flow-through entity. Information about Form W-8 IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. Other flow-through credit bases and information Credit bases Code Code Amount Amount.

When a PTE is required to file a Virginia return of income the owners of the entity will usually have a Virginia filing requirement also. Franchise tax is based on a taxable entitys margin. For record-keeping purposes a multi-state pass-through entity that operates in Maryland but does not fall under its income tax law can file a return reflecting no income owed to the state.

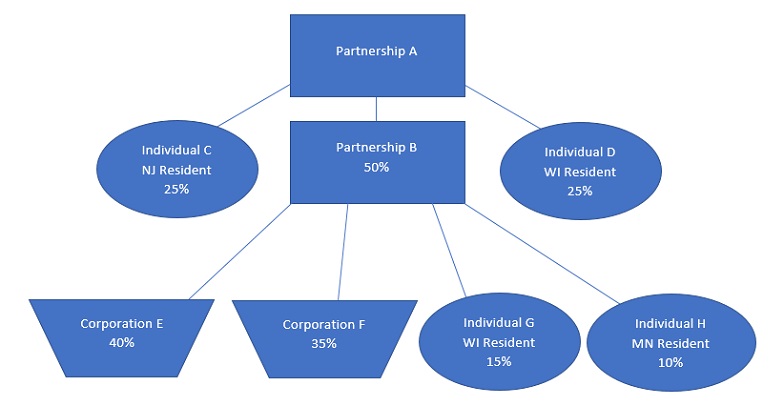

Income flowing to a Partnership D and S corporation E is not included in PTE taxable income. For owners who are not residents of Virginia filing may be simplified through the use of the. Any pass-through entity that falls under Maryland state income tax law must file on Form 510 even if it has no income or is inactive.

PTET deduction addback IT-653 Pass-Through Entity Tax Credit on Form IT-225 New York State Modifications. If you filed an election for capital property other than a flow-through entity your ACB is usually the amount you designated as proceeds of disposition on Form T664 or T664 Seniors. Part 1 Flow-through credit bases and information Brownfield redevelopment tax credit Form IT-611 IT-6111 or IT-6112 30 Site preparation credit.

Flow-Through Entity Tax Ask A Question Figures Needed for FTE Reporting. Michigan Homestead Property Tax Credits for Separated or Divorced Taxpayers. Branches for United States Tax Withholding and Reporting including recent updates related forms and instructions on how to file.

Q Did the partnership elect to pay the pass-through entity tax PTET for the current tax year. Sole proprietorships or disregarded entities like LLCs are filed on Schedule C or the state equivalent of the owners personal income tax return flow-through entities like S Corporations or Partnerships are generally required to file an informational return equivilent to the IRS Form 1120S or Form 1065 and full corporations must file the. Total revenue minus cost of goods sold COGS.

Form 1040 who timely paid. Resident Credit for Tax Imposed by a Canadian Province. Are selling all or part of your business.

PTE taxable income is computed including only amounts that flow through to individual partners B and C that are taxable under Article 22. See the Form 502W Instructions for more information. This tax is reported by the PTE on the Form 502W.

The following are all pass-through entities. Instructions included on form. Calculation of the Tax Margin.

4 When this election is made a PTE owner that is a qualified. Unless a taxable entity qualifies and chooses to file using the EZ computation the tax base is the taxable entitys margin and is computed in one of the following ways. Californias new elective PTE tax regime Under the Small Business Relief Act for tax years beginning in 2021 through 2025 3 a PTE that is a qualified entity may make an annual election to pay tax at the entity level on qualified net income at a rate of 93.

However for tax years beginning on or after January 1 2022 and before January 1 2026 the pass-through entity will be required to make minimum estimated tax payments on or before June 15. Many flow through business credits are available to certain individual taxpayers. Composite Individual Income Tax Return.

Want to know your current total tax liability with the Michigan Department of Treasury. The payees of payments other than income effectively connected with a US. Instructions included on form.

Total revenue times 70 percent. Claim a credit for inventory tax paid against individual income tax or corporation income tax and limited liability entity tax for tax years beginning on or after January 1 2018. A pass-through entity is an entity whose income loss deductions and credits flow through to members for Massachusetts tax purposes.

The credit is phased in with a 25 credit. An individual that elects not to participate in a composite return must file with the pass-through entity a Form PTE-EX within 30 days after his or her exemption.

Tax Guide For Pass Through Entities Mass Gov

Pass Through Entities Fiduciaries Withholding Tax Return It 1140 Department Of Taxation

9 Facts About Pass Through Businesses

Tax Treatment For C Corporations And S Corporations Under The Tax Cuts And Jobs Act Smith And Howard Cpa

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

Considerations For Filing Composite Tax Returns

The Latest On The New York Pass Through Entity Tax Marks Paneth

Qbi Deduction Frequently Asked Questions K1 Qbi Schedulec Schedulee Schedulef W2

What Is A Pass Through Entity Definition Meaning Example

Pass Through Taxation What Small Business Owners Need To Know

What Is A Disregarded Entity And How Are They Taxed Ask Gusto

Pass Through Entity Definition Examples Advantages Disadvantages

Hybrid Entities And Reverse Hybrid Entities International Tax Blog

Dor Pass Through Entity Level Tax Partnership Determining Income And Computing Tax

Flow Through Entity Overview Types Advantages

4 Types Of Business Structures And Their Tax Implications Netsuite