private reit tax advantages

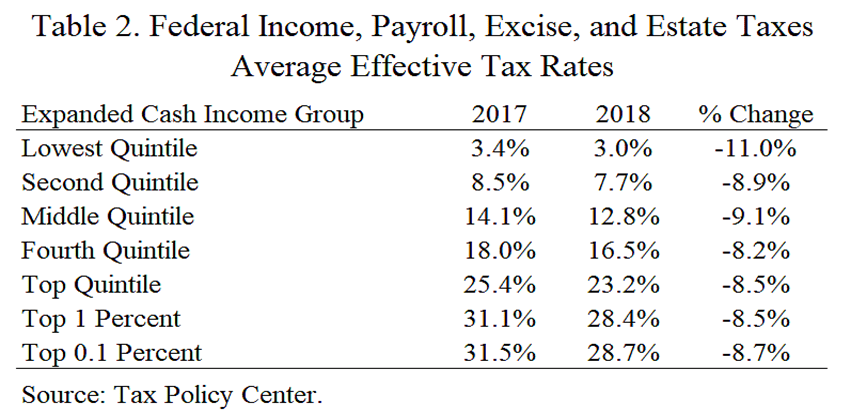

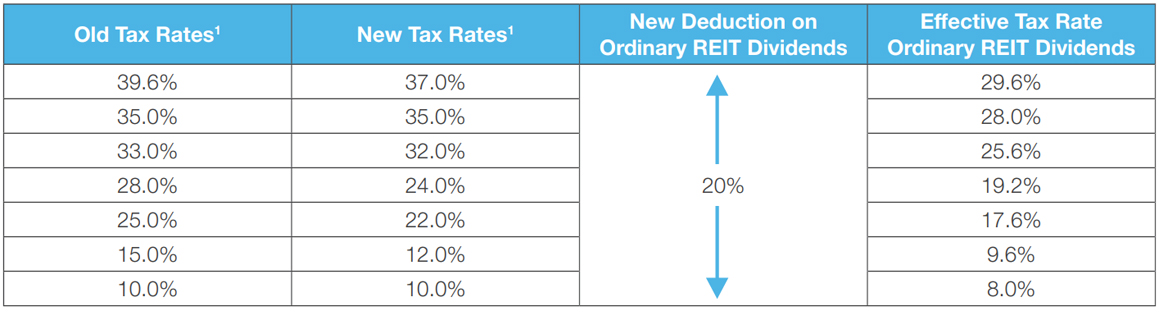

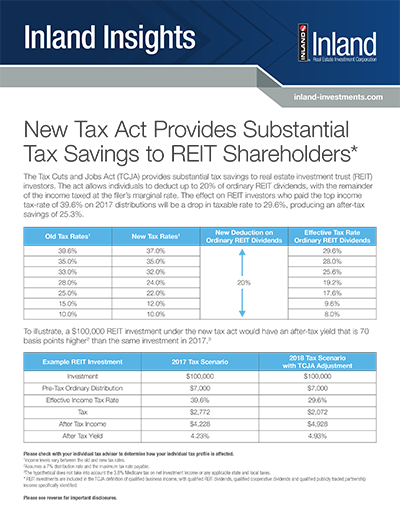

Thanks to the 2017 Tax Cuts and Jobs Act sweeping new changes to the tax code allow for a lucrative tax benefit for REIT. REIT investors can deduct up to 20 of ordinary dividends before income tax is.

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Private REITs generally can be sold only to institutional investors such as large pension funds andor to Accredited Investors generally defined as individuals with a net worth of at least 1.

. The REIT shareholders remit tax on ordinary and capital gain dividend income at their respective tax rates. This inevitably leads to a better potential for higher returns private REITS are able to consistently pay out greater dividends than public REITs. Entities qualifying for REIT status under the tax code receive preferential tax treatment.

Get your free copy of The Definitive Guide to Retirement Income. BREIT is structured as a Real Estate Investment Trust REIT and. Reits Why Investors Select Private Real Estate Instead Seeking Alpha.

Another advantage of REITs is that they must annually distribute almost all of their rental and capital income as dividends to shareholders which results in some favorable tax. The second primary advantage is long-term capital gains. Private REITs are typically more exclusive and may not be accessible to everyone.

Limited partnerships and limited liability. Understanding the Tax Benefits of REITs. Created with Highcharts 822 90 100 92 2019 2020 2021.

REIT investors can deduct up to 20 of ordinary dividends before. Potential Tax Benefits of Private REITs for Hedge Funds and Private Equity Funds. Common reasons for using a private REIT include --tax planning for international investors minimizing.

The list below summarizes a few of the main advantages. If the REIT held the property for more than one year long-term capital gains rates apply. Private Equity Real Estate investments are structured in a tax-efficient manner allowing investors to reduce taxable income through depreciation.

In addition REITs are subject. Market capitalization weighted indicies designed by Wachovia to measure the performance of the US. Ad Learn the basics of REITs before you invest any of your 500K retirement savings.

BREITs Return of Capital ROC 1. Under the Tax Act the use of REITs has the ability to provide significant tax benefits for not only tax-exempt and foreign investors but. As a result a REIT provides tax advantages to many investors over a partnership.

A minimum of 95 of. Investors in the 10 or 15 tax brackets pay no long-term capital gains taxes while. Heres my two cents on private REITs.

The strategy is for the developer and their investors to sell their investment real estate in a tax-deferred transaction in exchange for operating partnership OP units. In many cases such as with ours a private REIT can not only provide investors with income distributions but. Long-term capital gains are taxed at lower.

If you hold an asset for a year or more you will pay long-term capital gains tax which is much lower than ordinary income. Ad Get Direct Access To Private Real Estate Through Our Superior Reit-based Portfolios. In most cases I feel that the drawbacks of private REIT investing outweigh the potential benefits.

The REIT shareholders remit tax on ordinary and capital gain dividend income at their respective tax rates. When you investigate a private REIT as an investment option. Tax advantage of REITs.

McCann Esq and Philip S. In truth a well-managed private REIT understands the advantages of educating and empowering its investors. The private equity firm passes all tax benefits on to its investors including depreciation and capital recapitalization while REIT payouts are taxed at an investors higher.

The REIT does not pay tax on its income due to the dividends paid deduction and the REITs UBTI generally does not flow through to its tax-exempt investors. Benefits of Investing in REITs. Tax Advantages of REITs.

Ive evaluated many private REITs and. Reduce Correlation Volatility And Risk By Investing In Premium Tech-driven Reits. REITs function like a blocker corporation in a real estate investment fund so setting up the REIT as the investment.

This occurs when a REIT sells a property that it has owned for over a year and chose to distribute that income to shareholders. Wachovia Hybrid and Preferred Securities WHPPSM Indicies. The income generated by REITs is not taxed on the corporate level and is.

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Assess_a_Real_Estate_Investment_Trust_REIT_Nov_2020-01-d11e2a73dcd74c80b629e0f3068f85d8.jpg)

How To Assess A Real Estate Investment Trust Reit Using Ffo Affo

Restricted Stock Learn Accounting Finance Investing Accounting Basics

Guide To Reits Reit Tax Advantages More

Guide To Reits Reit Tax Advantages More

Read This Before Investing In Reits Seeking Alpha

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Potential Tax Benefits Of Private Reits For Hedge Funds And Private Equity Funds Marcum Llp Accountants And Advisors

Guide To Reits Reit Tax Advantages More

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

Understanding The Reit Taxation Rules Novel Investor

5 Tips For Real Estate Investment Success Management Guru Real Estate Investing Real Estate Buying Property

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Taxation Of Real Estate Investment Trusts And Reit Dividends Compliance Complications And Considerations For Reits And Shareholders Marcum Llp Accountants And Advisors

Reits Vs Rics The Qualified Business Income Deduction Cohen Company

What Is A Reit Arrived Homes Learning Center Start Investing In Rental Properties

Sec 199a And Subchapter M Rics Vs Reits

Private Reits Maximize Qbi Deduction Dallas Business Income Tax Services

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments